Earn up to 4.15% (variable) APY! Lock in your 0.65% boost through January 15, 2026. Terms apply. Learn more

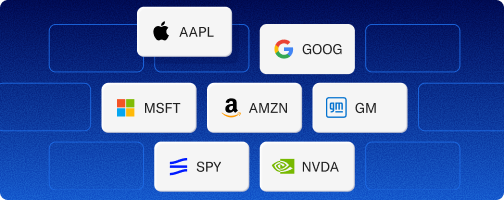

Self-directed investing is here

Trade thousands of stocks and ETFs on a platform you trust with no commissions and tax insights you won’t find anywhere else.

Logos above are trademarks of their respective companies.

Boost your savings up to 4.15% APY (variable) through January 15, 2026. New customers only. Terms apply.

Boost your savings up to 4.15% APY (variable) through January 15, 2026. New customers only. Terms apply.

Claim your offer Results for the long term

Results for the long term

Since its launch, our Core portfolio has delivered over 9% composite annual time-weighted returns after fees. Learn more

As of 12/31/2024, and inception date 9/7/2011. Composite annual time-weighted returns: 12.7% over 1 year, 7.9% over 5 years, and 7.8% over 10 years. Composite performance calculated based on the dollar-weighted average of actual client time-weighted returns for the Core portfolio at 90/10 allocation, net of fees, includes dividend reinvestment, and excludes the impact of cash flows. Performance not guaranteed, investing involves risk. Cash Reserve offered by Betterment LLC and requires a Betterment Securities brokerage account. Betterment is not a bank. FDIC insurance provided by Program Banks, subject to certain conditions. Learn more.

Buy Side on 3.3.25 for Feb ’25. Fee paid for logo use. See more.

Buy Side on 3.3.25 for Feb ’25. Fee paid for logo use. See more. Nerdwallet on 1.10.25 for Aug-Oct ’24. See more.

Nerdwallet on 1.10.25 for Aug-Oct ’24. See more. Weighted avg. app store rating as of 9.3.25 (reviews since: 9.10.10 Apple, 10.30.13 Google). See more.

Weighted avg. app store rating as of 9.3.25 (reviews since: 9.10.10 Apple, 10.30.13 Google). See more.

Start with our most popular accounts.

- INVESTAutomated investingBuild wealth with diversified, expert-built portfolios.Start investing

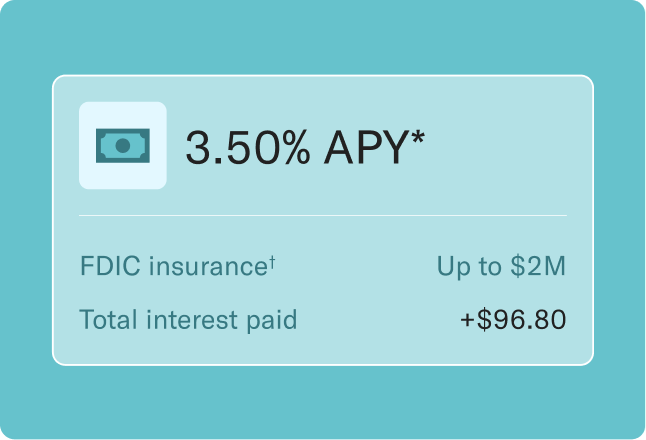

- SAVEHigh-yield cashEarn more interest on your savings with 3.50% variable APY.Start saving

- RETIREIRAsGrow your retirement savings with a tax-advantaged IRA.Open an IRA

Investing should always be this easy.

We manage your money for you—putting our technology behind every dollar you invest—so you can focus on living your life.

Managed portfoliosChoose from our curated portfolios or build your own—all using low-cost exchange-traded funds.View portfolio options

Save more in taxesWe use tax-loss harvesting to help turn market dips into tax savings In fact, Nearly 70% of customers using tax-loss harvesting covered their taxable advisory fees through estimated tax savings.

Ongoing optimizationWe monitor your investments, rebalance your portfolio, and reinvest dividends to help maximize your returns.

Based on 2022-2023. Tax Loss Harvesting (TLH) is not suitable for all investors. Consider your personal circumstances before deciding whether to utilize Betterment’s TLH feature. Fee coverage and estimated tax savings based on Betterment internal calculations. See more in disclosures.

Invest the way you want.

Choose from thousands of stocks and ETFs with Betterment by your side.

- See tax impact before you sell

- Trade fractional shares

- Pay no commission or management fees

Betterment waives its wrap fee on assets in self-directed investing accounts.

Boost your savings with a high-yield cash account.

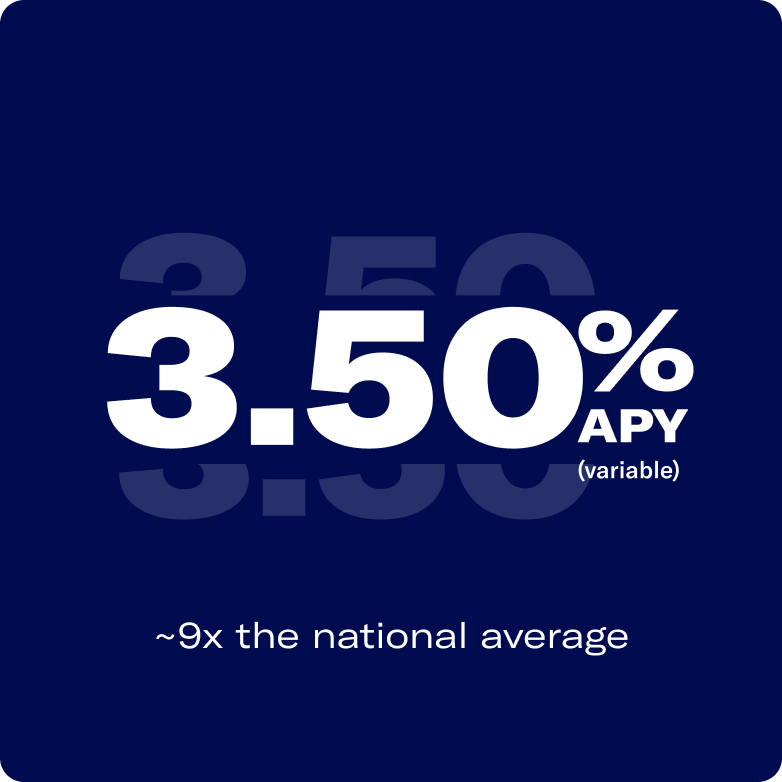

Don’t let traditional savings accounts keep your money from growing. Whether saving for an emergency fund or a big goal, our high-yield cash account earns interest at ~9x the national average.

$0 feesForget any monthly or maintenance costs—what you earn is what you keep.

$2M FDIC insuranceEnjoy up to $2 million ($4 million for joint accounts) FDIC insurance with our program banks, subject to certain conditions. FDIC-insured up to $2M is 8X what most firms offer.

Move money with easeEasily transfer cash to your investing account, set up recurring savings, and withdraw funds anytime you need.

The standard insurance amount of $250,000 per depositor, per insured bank, is provided by the FDIC and is subject to FDIC requirements.

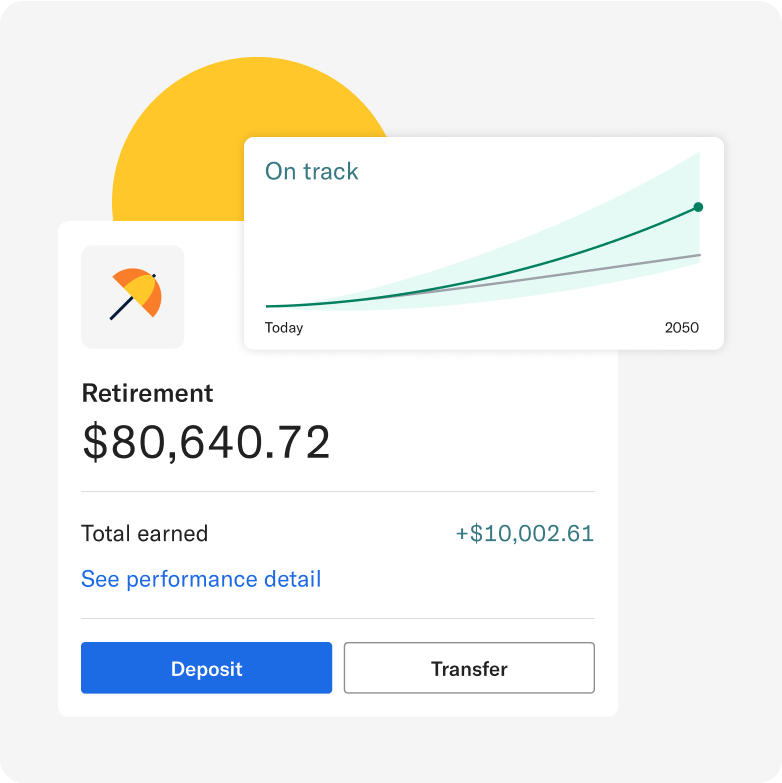

Feel confident about retirement with an IRA.

Grow your retirement savings with a tax-advantaged traditional, Roth, or SEP IRA. Get tax benefits along with our automated technology and full suite of planning tools.

Tax benefitsWe coordinate your retirement accounts for maximum tax efficiency, helping you save on taxes and grow your potential returns.Learn more

Lower feesRollovers to a Betterment IRA of low-cost ETFs can save on high 401(k) fees.Start a rollover

Retirement planningWe build you a personalized plan, recommend how much to save, and adjust as needed.

As the largest independent digital investment advisor, see what customers say about Betterment

Excellent place to make your money work for you.”

Kathryn H.

It’s a good “set-it-and-forget-it” investing tool for my family.”

Casey M.

Saves the stress and hassle of managing retirement savings myself”

David S.

Client. Views may not be representative. See App Store & Google Play reviews.

Still have questions?

- How does Betterment work?

- Will I have access to real humans?

- Is my money safe at Betterment?

- Who are the experts behind the scenes?

Make your money hustle.

- Accounts

- Tools

- Service

- Resources

- About

- Rewards

- Disclosures

Based on actual advisory fees paid on taxable accounts only for Betterment individual retail client users in 2022-2023. Tax savings calculations are based on clients’ self-reported income, tax filing status, and reported number of dependents, and they assume the standard deduction. Betterment’s calculations do not take into account the effects of any trades that may have occurred outside of Betterment in clients’ external accounts. This figure pertains to 2022 only, and does not consider any losses or gains from prior years. Note that harvest opportunities vary depending on market conditions in a given calendar year; 2022 may not be representative. Tax savings through TLH are not a measure of investment performance and results are not guaranteed. Please see Betterment’s TLH White Paper and TLH Disclosure for more information. Betterment is not a licensed tax advisor. Tax Loss Harvesting (TLH) is not suitable for all investors, and certain conditions apply; consider your personal circumstances before deciding whether to utilize Betterment’s TLH feature.

National average savings account annual percentage yield (APY) (as of October 29, 2025) for savings accounts under $100,000, per FDIC.

Annual percentage yield (variable) is 3.50% as of October 31, 2025, plus a 0.65% boost (“APY Boost”) for new clients with a qualifying deposit. $10 min deposit for base APY. Terms apply; if the base APY changes, the Boosted APY will change.

Annual percentage yield (variable) is 3.50% as of October 31, 2025, plus a 0.25% boost (“APY Boost”); clients must maintain the Premium $100k account threshold across eligible investments; other terms apply. $10 min deposit for base APY. If the base APY changes, the Boosted APY will change.

The reported customer count of 1 Million+ is as of Oct. 21, 2025, and is inclusive of checking and investing clients.

Betterment’s reported assets under management (AUM) of $65 Billion+ is as of Oct. 21, 2025.

Betterment does not provide tax advice. TLH is not suitable for all investors. Learn more.

Checking accounts and the Betterment Visa Debit Card provided by and issued by nbkc bank, Member FDIC. Betterment Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted. Checking accounts do not earn APY (annual percentage yield). Betterment Cash Reserve and Betterment Checking are separate offerings and are not linked accounts.

Any balances you hold with nbkc bank, including but not limited to those balances held in Betterment Checking accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. Betterment is not FDIC-insured. FDIC insurance only covers the failure of an insured bank. If you have funds jointly owned, these funds would be separately insured for up to $250,000 for each joint account owner. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Betterment Checking accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank- list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation. Additional information on FDIC insurance can be found at https://www.fdic.gov/resources/deposit-insurance/.

Logos are trademarks of respective companies. © 2025 FactSet Research Systems Inc. All rights reserved.

Learn more about Self-Directed Investing.

IMPORTANT BETTERMENT DISCLOSURES

Information is educational only and not investment or tax advice. External links are educational, and do not imply Betterment’s endorsement. All screenshots are for illustrative purposes only.

Who Provides What Service?Investment Advice: Advisory services are provided by Betterment LLC, an SEC-registered investment adviser. Betterment LLC’s internet-based advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. Betterment is not a tax advisor.

Brokerage Services & Custody: Brokerage services are provided to clients of Betterment LLC by Betterment Securities, an SEC-registered broker-dealer and member of FINRA/SIPC, and Apex Clearing Corporation, a third-party SEC registered broker-dealer and member FINRA/SIPC.

Betterment Checking: Betterment Checking is made available through Betterment Financial LLC. Checking accounts and the Betterment Visa Debit Card provided by and issued by nbkc bank, Member FDIC. See Betterment Checking Disclosure.

Betterment at Work: 401(k) plan administration services provided by Betterment for Business LLC. Investment advice to plans and plan participants provided by Betterment LLC, an SEC registered investment adviser.

No Betterment entity is a bank.

Special Disclosure for Betterment Cash Reserve

Betterment Cash Reserve is offered by Betterment LLC and requires a Betterment Securities brokerage account. Client funds in Cash Reserve are deposited into one or more FDIC-insured banks (“Program Banks”), where they earn variable interest and are eligible for FDIC insurance (subject to certain conditions). Funds in brokerage accounts are protected by SIPC, but funds at Program Banks are FDIC-insured up to $250K per depositor per bank, with a potential aggregate limit of $2M ($4M for joint accounts) once the funds reach one or more Program Banks. Funds in transit to or from Program Banks are generally not FDIC-insured but are covered by SIPC. FDIC insurance limits include all accounts held at a bank, not just Cash Reserve funds. For details, see Betterment’s Cash Reserve T&Cs and Form ADV Part 2. FDIC insurance information is available at FDIC.gov.

Let’s Talk About Risk:Investing involves risk and there is the potential of losing money when you invest in securities. Past performance does not guarantee future results and the likelihood of investment outcomes are hypothetical in nature.Investments in securities are: Not FDIC Insured • Not Bank Guaranteed • May Lose Value. Before investing, consider your investment objectives and Betterment LLC’s fees and expenses. For more details, see Betterment’s Form CRS, Form ADV Part II and other disclosures. Not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Betterment LLC is not registered.

Who Provides the Market Data? Market Data by Xignite and FactSet. Copyright © 2025 FactSet Research Systems Inc. Fund data © 2022 Morningstar. All Rights Reserved.

© Betterment Holdings Inc. All rights reserved.Betterment, 450 West 33rd Street, FL 11 New York, NY 10001

You are viewing a web property located at Betterment.com. Different properties may be provided by a different entity with different marketing standards.

- Site Map

- Terms of Use

- Privacy Policy

- Trademark

- Legal Directory

- Privacy controls

Google Play and the Google Play logo are trademarks of Google, Inc.

Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S.

Betterment assumes no responsibility or liability whatsoever for the content, accuracy, reliability or opinions expressed in a third-party website, to which a published article links (a “linked website”). Such linked websites are not monitored, investigated, or checked for accuracy or completeness by Betterment. It is your responsibility to evaluate the accuracy, reliability, timeliness and completeness of any information available on a linked website. All products, services, and content obtained from a linked website are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. If Betterment has a relationship or affiliation with the author or content, it will note this in additional disclosure.